“If truth is the first casualty in wars, bonds usually come a close second.”

Get your Free

financial review

Our friend Tony Deden may be the person who has thought about risk more profoundly than anyone else we’ve met. Tony’s objective, like ours, is to preserve his clients’ capital – in real terms – and thereafter generate attractive returns. But capital preservation comes first. Here is just a small portion of what he said at an investment conference in Zurich in November 2009:

“To be an investor in our times without an understanding of history, classic economic theory or the common sense of our grandfathers is a recipe for disaster. And there is more disaster to come.

“Here is my summary: In pursuing my goals in capital preservation, I am interested in tangible assets – not promises, not claims, not contracts, not confidence and not hope. I will continue to pursue wealth creation by participating in the capital of the few remaining outstanding entrepreneurs. And I will continue holding cash for a while, expecting to find opportunities to use the latter to purchase more of the former. I do not really trust the money issued by governments. And so, I see gold as a tool in the same manner I see common stocks, bonds, or just any other type of asset.

“Let me be very blunt: the discovery of value and/or wise speculation becomes extremely difficult, if not impossible, in an irrational and dysfunctional economic system.

“And so, at different times, for different reasons, in different amounts and for different purposes, none of which are suited for a simple explanation or a model—I seek to have such a mixture so as to pursue a noble cause in the economic life of those I serve—capital owners and savers—that of seeking to protect their savings from the rent-seekers, the fools, thieves and assorted charlatans that clutter our world.”

The single most influential investment book we’ve read is probably ‘Against the Gods’, Peter L. Bernstein’s magisterial history of risk. The reason it made such an impact on us was down to its reference to Daniel Bernoulli, who we have long argued has a good claim to be one of the first behavioural economists. Bernoulli, a genuine Renaissance man, was a mathematician and physicist who also observed that when you’re managing money for wealthy people, the trick is simply not to lose it. As he put it,

“The practical utility of any gain in portfolio value inversely relates to the size of the portfolio.”

In plainer English, the more you have, the less you need. More to the point, the more you have, the less risk you probably want to take. Bernoulli was referring to the wealthy, but we think the lesson still holds for just about everyone.

Bernoulli’s insight came two centuries ahead of the behavioural studies for which the psychologists Daniel Kahneman and Amos Tversky became famous, and for which Kahneman would win a Nobel Prize for Economics. Their key observation (at least to us) was that, as investors, our tolerance for gains and losses is not equal. Losses matter more. Human beings are naturally loss-averse. Faced with a portfolio gain or loss of equivalent magnitude – say £10,000, to keep it interesting – incurring the loss will typically be felt with between two and three times the severity of enjoying the gain. This asymmetrical attitude to risk is just one of the reasons why we try to focus on capital preservation. Because losing money hurts.

Unfortunately for all of us, the way that central banks have conducted monetary policy for the past two decades has meant that we have all been forced to take on a lot more risk than we would otherwise have chosen. in a world where deposit rates barely compensate for official inflation – let alone the true rate of inflation – it makes next to no sense having money in the bank for any reason other than as a store of liquidity. So stock and bond markets, and of course property markets, have been the beneficiaries of tidal waves of capital being redirected from largely useless bank accounts into what the City refers to as “risk assets”.

At least, that has been the case until now.

The most important markets in the world are those that derive from economic activity in the United States. The US stock market is the biggest in the world, accounting for over 70% of the entire MSCI World Index. The US bond market is the biggest in the world. The US dollar is the world’s single largest reserve currency (albeit gold is gaining at a rate of knots). So what happens in US markets has a significant impact on what happens throughout world markets for understandable reasons.

And in the US equity market, market breadth is something of a joke, while the national debt stands at over $37 trillion – it will never realistically be paid back, except in devalued dollars. We are not in Kansas any more, and more to the point, we haven’t been there for years.

The good folk at Incrementum in Lichtenstein recently released their latest study of the gold market, ‘In Gold We Trust’. As they point out,

“A new, secular bull market is forming. The golden decade we announced in our In Gold We Trust report 2020, when gold was trading at only USD 1,500, is in full swing. The Big Long is our renewed call to question the generally low gold allocation among investors and to weight safe-haven gold and performance gold to a considerable extent.

“The US’s much-discussed customs and trade policy is just one aspect of a comprehensive realignment. With Liberation Day, Donald Trump has triggered a systemic quake that could result in a reorganization of the monetary architecture.

“The Triffin dilemma is once again taking centre stage in the currency debate: A sustainable solution can only be found via a neutral reserve asset such as gold or Bitcoin.”

We have long held that the single biggest threat to investors is a combined bear market in both stocks and bonds at the same time. Which is why we remain so sceptical about the role of the so-called “60/40” portfolios that are still, by and large, being foisted on clients of wealth management firms today – where circa 60% of the client portfolio is allocated to stocks (typically index-weighted) and circa 40% is allocated to bonds (ditto).

This is not asset diversification. It is concentrating your portfolio in two asset classes, one of which has no legitimate investment case, that may end up being highly correlated in a rising interest rate environment.

At the political level, of course, 2025 could hardly have been a wilder ride. Trump 2.0 has led to global uncertainty over tariffs, and a variety of wars are keeping a flame under food and commodity prices. And of course, central bank money printing continues quietly behind the scenes.

So what happens to be one of the best insurance policies against rising inflation and widening political turmoil ?

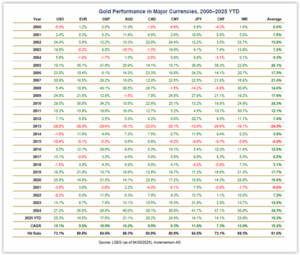

As Incrementum point out, gold’s performance since the start of the millennium has been not just decent but surprisingly consistent, whichever currency you choose to measure it against:

Gold performance since 2000, various currencies

Gold’s average annual return has been anything between 7% and 13% depending on the currency in question – provided investors were strong-willed enough to hold on for the long run and during the falls. But there is an inherent framing problem when we express gold in terms of its worth in other things. We know, for example, what a kilogram is: “the mass of the International Prototype of the Kilogram”, a cylinder made of platinum-iridium alloy stored by the International Bureau of Weights and Measures at Saint-Cloud in France.

So what’s a dollar worth ? (Or a pound sterling ?)

This is a problem – for believers in dollars and pounds, at any rate. The investment consultant Andreas Acavalos – a consultant to Tony Deden’s firm – has nicely described the problem as follows. Trying to evaluate the price of gold using a fiat currency is like trying to measure a suit using a piece of elastic. Seen in this way,

“Gold is not even an investment. It is a conscious decision to refrain from investing until an honest monetary regime makes the rational calculation of relative asset prices possible.” [Emphasis ours.]

In our investment practice we advocate holding gold in three forms. The first, and arguably the most important, is the physical asset itself. The second would be in a collective structure within which the gold cannot be lent out, or rehypothecated. For investors with a sufficient risk appetite, we then recommend holding gold and silver miners – which clearly introduces equity risk (and potential returns) into the mix.

And then, of course, there are all the other component parts that make up a sensibly balanced portfolio (minus, at least for us, bonds) – and the most useful for the cause of wealth creation are shares in high quality businesses, run by principled, shareholder-friendly management, especially when those shares can be purchased either close to, or below, a fair assessment of their underlying value.

But to reiterate, our primary concern is capital preservation. It seems to us that the current heightened volatility across all financial markets and asset classes is a precursor to some sort of overdue reckoning. We have long been concerned by this warning from the great Austrian economist Ludwig von Mises:

“The credit expansion boom is built on the sands of banknotes and deposits. It must collapse. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

In 2008 we failed to foresee just how extraordinarily the world’s central banks would flood the system with money to keep the banks afloat. Now, not least in the US, after almost two decades of unprecedented credit expansion and financial interference, that noise you can hear is the bond market vigilantes riding back into town.

Got gold ?

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

“If truth is the first casualty in wars, bonds usually come a close second.”

Get your Free

financial review

Our friend Tony Deden may be the person who has thought about risk more profoundly than anyone else we’ve met. Tony’s objective, like ours, is to preserve his clients’ capital – in real terms – and thereafter generate attractive returns. But capital preservation comes first. Here is just a small portion of what he said at an investment conference in Zurich in November 2009:

“To be an investor in our times without an understanding of history, classic economic theory or the common sense of our grandfathers is a recipe for disaster. And there is more disaster to come.

“Here is my summary: In pursuing my goals in capital preservation, I am interested in tangible assets – not promises, not claims, not contracts, not confidence and not hope. I will continue to pursue wealth creation by participating in the capital of the few remaining outstanding entrepreneurs. And I will continue holding cash for a while, expecting to find opportunities to use the latter to purchase more of the former. I do not really trust the money issued by governments. And so, I see gold as a tool in the same manner I see common stocks, bonds, or just any other type of asset.

“Let me be very blunt: the discovery of value and/or wise speculation becomes extremely difficult, if not impossible, in an irrational and dysfunctional economic system.

“And so, at different times, for different reasons, in different amounts and for different purposes, none of which are suited for a simple explanation or a model—I seek to have such a mixture so as to pursue a noble cause in the economic life of those I serve—capital owners and savers—that of seeking to protect their savings from the rent-seekers, the fools, thieves and assorted charlatans that clutter our world.”

The single most influential investment book we’ve read is probably ‘Against the Gods’, Peter L. Bernstein’s magisterial history of risk. The reason it made such an impact on us was down to its reference to Daniel Bernoulli, who we have long argued has a good claim to be one of the first behavioural economists. Bernoulli, a genuine Renaissance man, was a mathematician and physicist who also observed that when you’re managing money for wealthy people, the trick is simply not to lose it. As he put it,

“The practical utility of any gain in portfolio value inversely relates to the size of the portfolio.”

In plainer English, the more you have, the less you need. More to the point, the more you have, the less risk you probably want to take. Bernoulli was referring to the wealthy, but we think the lesson still holds for just about everyone.

Bernoulli’s insight came two centuries ahead of the behavioural studies for which the psychologists Daniel Kahneman and Amos Tversky became famous, and for which Kahneman would win a Nobel Prize for Economics. Their key observation (at least to us) was that, as investors, our tolerance for gains and losses is not equal. Losses matter more. Human beings are naturally loss-averse. Faced with a portfolio gain or loss of equivalent magnitude – say £10,000, to keep it interesting – incurring the loss will typically be felt with between two and three times the severity of enjoying the gain. This asymmetrical attitude to risk is just one of the reasons why we try to focus on capital preservation. Because losing money hurts.

Unfortunately for all of us, the way that central banks have conducted monetary policy for the past two decades has meant that we have all been forced to take on a lot more risk than we would otherwise have chosen. in a world where deposit rates barely compensate for official inflation – let alone the true rate of inflation – it makes next to no sense having money in the bank for any reason other than as a store of liquidity. So stock and bond markets, and of course property markets, have been the beneficiaries of tidal waves of capital being redirected from largely useless bank accounts into what the City refers to as “risk assets”.

At least, that has been the case until now.

The most important markets in the world are those that derive from economic activity in the United States. The US stock market is the biggest in the world, accounting for over 70% of the entire MSCI World Index. The US bond market is the biggest in the world. The US dollar is the world’s single largest reserve currency (albeit gold is gaining at a rate of knots). So what happens in US markets has a significant impact on what happens throughout world markets for understandable reasons.

And in the US equity market, market breadth is something of a joke, while the national debt stands at over $37 trillion – it will never realistically be paid back, except in devalued dollars. We are not in Kansas any more, and more to the point, we haven’t been there for years.

The good folk at Incrementum in Lichtenstein recently released their latest study of the gold market, ‘In Gold We Trust’. As they point out,

“A new, secular bull market is forming. The golden decade we announced in our In Gold We Trust report 2020, when gold was trading at only USD 1,500, is in full swing. The Big Long is our renewed call to question the generally low gold allocation among investors and to weight safe-haven gold and performance gold to a considerable extent.

“The US’s much-discussed customs and trade policy is just one aspect of a comprehensive realignment. With Liberation Day, Donald Trump has triggered a systemic quake that could result in a reorganization of the monetary architecture.

“The Triffin dilemma is once again taking centre stage in the currency debate: A sustainable solution can only be found via a neutral reserve asset such as gold or Bitcoin.”

We have long held that the single biggest threat to investors is a combined bear market in both stocks and bonds at the same time. Which is why we remain so sceptical about the role of the so-called “60/40” portfolios that are still, by and large, being foisted on clients of wealth management firms today – where circa 60% of the client portfolio is allocated to stocks (typically index-weighted) and circa 40% is allocated to bonds (ditto).

This is not asset diversification. It is concentrating your portfolio in two asset classes, one of which has no legitimate investment case, that may end up being highly correlated in a rising interest rate environment.

At the political level, of course, 2025 could hardly have been a wilder ride. Trump 2.0 has led to global uncertainty over tariffs, and a variety of wars are keeping a flame under food and commodity prices. And of course, central bank money printing continues quietly behind the scenes.

So what happens to be one of the best insurance policies against rising inflation and widening political turmoil ?

As Incrementum point out, gold’s performance since the start of the millennium has been not just decent but surprisingly consistent, whichever currency you choose to measure it against:

Gold performance since 2000, various currencies

Gold’s average annual return has been anything between 7% and 13% depending on the currency in question – provided investors were strong-willed enough to hold on for the long run and during the falls. But there is an inherent framing problem when we express gold in terms of its worth in other things. We know, for example, what a kilogram is: “the mass of the International Prototype of the Kilogram”, a cylinder made of platinum-iridium alloy stored by the International Bureau of Weights and Measures at Saint-Cloud in France.

So what’s a dollar worth ? (Or a pound sterling ?)

This is a problem – for believers in dollars and pounds, at any rate. The investment consultant Andreas Acavalos – a consultant to Tony Deden’s firm – has nicely described the problem as follows. Trying to evaluate the price of gold using a fiat currency is like trying to measure a suit using a piece of elastic. Seen in this way,

“Gold is not even an investment. It is a conscious decision to refrain from investing until an honest monetary regime makes the rational calculation of relative asset prices possible.” [Emphasis ours.]

In our investment practice we advocate holding gold in three forms. The first, and arguably the most important, is the physical asset itself. The second would be in a collective structure within which the gold cannot be lent out, or rehypothecated. For investors with a sufficient risk appetite, we then recommend holding gold and silver miners – which clearly introduces equity risk (and potential returns) into the mix.

And then, of course, there are all the other component parts that make up a sensibly balanced portfolio (minus, at least for us, bonds) – and the most useful for the cause of wealth creation are shares in high quality businesses, run by principled, shareholder-friendly management, especially when those shares can be purchased either close to, or below, a fair assessment of their underlying value.

But to reiterate, our primary concern is capital preservation. It seems to us that the current heightened volatility across all financial markets and asset classes is a precursor to some sort of overdue reckoning. We have long been concerned by this warning from the great Austrian economist Ludwig von Mises:

“The credit expansion boom is built on the sands of banknotes and deposits. It must collapse. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

In 2008 we failed to foresee just how extraordinarily the world’s central banks would flood the system with money to keep the banks afloat. Now, not least in the US, after almost two decades of unprecedented credit expansion and financial interference, that noise you can hear is the bond market vigilantes riding back into town.

Got gold ?

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price