“Nobody ever saw a dog make a fair and deliberate exchange of one bone for another with another dog.. When an animal wants to obtain something either of a man or of another animal, it has no other means of persuasion but to gain the favour of those whose service it requires. A puppy fawns upon its dam, and a spaniel endeavours by a thousand attractions to engage the attention of its master who is at dinner, when it wants to be fed by him. Man sometimes uses the same arts with his brethren, and when he has no other means of engaging them to act according to his inclinations, endeavours by every servile and fawning attention to obtain their good will. He has not time, however, to do this upon every occasion. In civilised society he stands at all times in need of the cooperation and assistance of great multitudes, while his whole life is scarce sufficient to gain the friendship of a few persons..

“[M]an has almost constant occasion for the help of his brethren, and it is in vain for him to expect it from their benevolence only. He will be more likely to prevail if he can interest their self-love in his favour, and show them that it is for their own advantage to do for him what he requires of them. Whoever offers to another a bargain of any kind, proposes to do this. Give me that which I want, and you shall have this which you want, is the meaning of every such offer; and it is in this manner that we obtain from one another the far greater part of those good offices which we stand in need of. It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love..”

- Adam Smith, ‘The Wealth of Nations’.

Get your Free

financial review

Roughly 90,000 years ago, something rather wonderful happened. The evidence lies in the form of a simple snail shell called Nassarius. This little shell can be found scattered across archaeological sites in Morocco, Algeria and Israel. These shells sport some holes that cannot have been made naturally. Some of them are smeared with red ochre. Almost certainly these shells were worn as beads, on a string. They offer evidence of early man’s interest in personal ornamentation, perhaps money – and trade. Some of the locations in which Nassarius has been found are as much as 125 miles from the nearest coast. These beads probably migrated, from hand to hand, by exchange. Modern man is hardwired to trade.

The science writer Matt Ridley describes barter as “the trick that changed the world”. Trade begat technological exchange and specialisation – the cornerstones of economic progress. Whereas Yuval Noah Harari suggests that the reason for homo sapiens’ victory over all the other forms of early man comes down to our love of narrative (we happen to like this theory ourselves), it is almost certainly free exchange that made the real difference. Trade predates society.

And then tribalism got in the way. Kings (the big men on campus), priests (the ‘essential’ translators of the otherwise inexplicable) and thieves (bullies) managed to insinuate themselves between the free traders, and we have been in a fallen world ever since.

How else to explain the rut we have fallen into over the belligerent trade posturing between Trump 2.0 and the rest of the world ? Most of us just want to get on with the business of free exchange, free trade, and wealth creation. But governments insist on getting in the way, and extorting our money from us with their menaces.

Longstanding readers will be familiar with our strong belief that, because government intervention in the economy always has consequences, many of which run counter to what it often claims to be supporting, government itself should be kept as small as possible, in order that it do as little inadvertent damage as possible. The argument is best advocated and summarised in this book and its title: Forty Centuries of Wage and Price Controls – how not to fight inflation. (The link allows you to download a PDF copy of the book, entirely free, from the Mises website.) Please note that we are not – yet – anarchists; we believe that government should be kept small, in order to minimise its interference in the productive lives of those in the private sector (who make government possible in the first place, through their taxes), not that it should not exist at all. But as every day goes by in this madhouse of a world, the anarchist perspective becomes more and more desirable.

Our tortuous collective pilgrimage of the last nine years in the vague direction of Brexit, for example, has done a lot of things. Perhaps most weirdly, it has reinforced the Marxist credentials of both ‘The Economist’ and the ‘Financial Times’. You thought that these journals were pro-business, pro-free market, and anti-Big State ? Yes, we used to think that, too.

Suffice to say, regardless of which way you voted in the EU referendum, if you did, we doubt whether you can be satisfied at the outcome to date. Many Remainers will be placated by nothing other than re-entry into the European Union. Leavers and Remainers will likely be equally aghast at the travesty of supposed negotiation that has occurred to date. To trace the problem back to its source, we cite a longstanding influence on our own fundamental macro-economic and investment thinking, the late Dr Albert Bartlett, physics professor at the University of Colorado at Boulder, and the presenter of what has been quite fairly described as one of the most important videos that you’ll ever see (which you can watch here). Bartlett suggested that one of mankind’s greatest failures was our inability to understand the power of the exponential function, also known as the miracle of compounding. Bartlett went on to advocate the contentious-sounding thesis that for any entity beyond maturity, further growth equates either to obesity, or cancer. Ladies and gentlemen, we present: the European Union. (Lest we be accused of geographic or political bias, we also present: the US national debt.)

But if, like us, you believe that government should be as small as humanly possible in order for it to be less rather than more harmful (the Swiss model being a particularly good one), you cannot then logically endorse the European project.

For many Leave voters, the matter of sovereignty carried more weight than any other single issue. Economic matters were of secondary, though still crucial, importance. Our own hostility to the European project derived from a pragmatic acknowledgment of the human condition. Humans are tribal creatures. Technocrats in Brussels may believe that it’s possible to subsume national identities within a larger pan-national bureaucracy, but we doubt whether the majority of the people of France, Italy, Greece and the other members of the remaining EU 27 really desire that outcome.

To reiterate a longstanding observation, the members of a centralised euro currency zone are trapped within a latter-day gold standard. Because its member countries have no control over their own monetary policy, they must accept a one-size-fits-all model. But what is appropriate today for an economy like Germany’s is unlikely to be appropriate for an economy like that of Greece. (Which should never have been allowed to join in the first place – but then institutionalised corruption is another of the euro zone’s fatal flaws. Are the EU’s accounts and payments “free from material error” ? On this basis they haven’t been signed off by the EU’s own Court of Auditors for over 20 years.)

The euro zone is simply too big to function properly. Given the widely various cultures of the euro zone, it was always going to be a big ask for such a diverse patchwork of countries to try and move lock-step together.

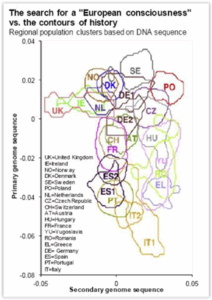

As JP Morgan’s Michael Cembalest points out, there is disturbingly little commonality amongst those disparate cultures. The graphic below shows DNA mappings of European citizens (courtesy of ‘Current Biology Magazine’, August 2008). While genetic variations are relatively small, those variations are tied very closely to geography. As Cembalest observes, by grouping similar DNA results together, we get something that looks very much like a map of Europe – a map that reflects “hundreds of years of migration, weddings, funerals, births, language, values passed to children, circumstances that call for charity, sacrifice, revenge and everything else that defines ‘culture’.”

As Cembalest puts it,

“The map shows clear patterns of ancestry tied to geography, which is perhaps why the EMU was designed to retain the region’s fiscal, economic and cultural identities. Perhaps we should not be surprised that Northern Europe is struggling with whether it will mortgage its future to save the South.”

And perhaps the ultimate will to save Europe simply does not exist.

“In terms of shared experiences and values measured by anthropologists, and the contours of history implied by genetic research, they may not have enough in common. It took almost 150 years for the US to reach the same point in its history, when it began to cede more control to a Federal, centralised government.”

Whenever sceptics expressed concern at the EU’s uncertain direction of travel and its acceleration regardless, it was met with a standard response: the answer is more Europe. Well, not any more. Not for the UK, at least.

The tragedy for the benighted people of the United Kingdom is that, just when we were at the point of shaking off the shackles of our economic ties to Europe, enough of us voted for a Labour government under Keir Starmer that seems determined to drag us back in, albeit on the worst commercial terms imaginable, and which never saw a tax hike that it didn’t like. So the opportunity to remake the UK as Singapore-on-Thames now looks to have been entirely squandered.

The dismal collapse of Britain’s economic prospects reflects a sublime inability (or steadfast refusal) to recognize the superiority of Adam Smith’s world of free trade, entrepreneurialism and invisible hands. All of which have been replaced by the Big State’s all too visible hand as it reaches into our collective pocket in search of capital to perpetuate its economically unviable pipe dreams. Labour hates success, and it hates wealth unless it represents the increasingly narrow interests of its voter base.

All of which provoked ‘The Telegraph’ in its editorial of 8th July 2025 to issue the following verdict:

“It is difficult to think of a better summary of Britain’s difficulties than that offered by Richard Hughes, chair of the Office for Budget Responsibility: “the UK cannot afford the array of promises that it has made to the public”.

“This observation was backed by dismal forecasts showing debt on course to reach 270 per cent of GDP by 2070, and the note that challenging global and domestic circumstances risk further shocks to the public finances. Yet at Westminster there is little sign that MPs have realised the precarious position Britain finds itself in. Indeed, Labour’s 2024 intake of MPs seem to believe that the Government’s finances are limitless in their depth.

“The rebellion that recently rocked the Government was over a £5 billion cut in a health and disability benefits bill set to reach £70 billion a year by 2030 – a fraction of the forecast spend. The result was another U-turn in attempts to arrest rising spending, going alongside the failed attempt to reform old-age benefits.

“This, in turn, suggests that Britain’s finances will continue towards what Mr Hughes calls an “unsustainable position” until we are jolted from our complacency by the vigilance of the bond markets, or an even less desirable intervention. It would clearly be preferable to rein in the growth of spending now, voluntarily.

“The older meaning of the word “crisis” as a turning point in a malady is apposite here. The British disease – welfarism, an elite class unwilling to reckon with the need for change, a state that strangles entrepreneurial activity and investment – is reaching its peak. Whether the patient will recover before extraordinary measures are necessitated is unclear.”

According to the popular maxim, hard times create strong men; strong men create good times; good times create weak men; and weak men create hard times. We think a 2025 revision is overdue: hard times create entrepreneurs; entrepreneurs create good times; good times create weak men; and weak men form Labour governments. We need to relearn the lessons of Adam Smith and of Nassarius – in a hurry.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

“Nobody ever saw a dog make a fair and deliberate exchange of one bone for another with another dog.. When an animal wants to obtain something either of a man or of another animal, it has no other means of persuasion but to gain the favour of those whose service it requires. A puppy fawns upon its dam, and a spaniel endeavours by a thousand attractions to engage the attention of its master who is at dinner, when it wants to be fed by him. Man sometimes uses the same arts with his brethren, and when he has no other means of engaging them to act according to his inclinations, endeavours by every servile and fawning attention to obtain their good will. He has not time, however, to do this upon every occasion. In civilised society he stands at all times in need of the cooperation and assistance of great multitudes, while his whole life is scarce sufficient to gain the friendship of a few persons..

“[M]an has almost constant occasion for the help of his brethren, and it is in vain for him to expect it from their benevolence only. He will be more likely to prevail if he can interest their self-love in his favour, and show them that it is for their own advantage to do for him what he requires of them. Whoever offers to another a bargain of any kind, proposes to do this. Give me that which I want, and you shall have this which you want, is the meaning of every such offer; and it is in this manner that we obtain from one another the far greater part of those good offices which we stand in need of. It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love..”

Get your Free

financial review

Roughly 90,000 years ago, something rather wonderful happened. The evidence lies in the form of a simple snail shell called Nassarius. This little shell can be found scattered across archaeological sites in Morocco, Algeria and Israel. These shells sport some holes that cannot have been made naturally. Some of them are smeared with red ochre. Almost certainly these shells were worn as beads, on a string. They offer evidence of early man’s interest in personal ornamentation, perhaps money – and trade. Some of the locations in which Nassarius has been found are as much as 125 miles from the nearest coast. These beads probably migrated, from hand to hand, by exchange. Modern man is hardwired to trade.

The science writer Matt Ridley describes barter as “the trick that changed the world”. Trade begat technological exchange and specialisation – the cornerstones of economic progress. Whereas Yuval Noah Harari suggests that the reason for homo sapiens’ victory over all the other forms of early man comes down to our love of narrative (we happen to like this theory ourselves), it is almost certainly free exchange that made the real difference. Trade predates society.

And then tribalism got in the way. Kings (the big men on campus), priests (the ‘essential’ translators of the otherwise inexplicable) and thieves (bullies) managed to insinuate themselves between the free traders, and we have been in a fallen world ever since.

How else to explain the rut we have fallen into over the belligerent trade posturing between Trump 2.0 and the rest of the world ? Most of us just want to get on with the business of free exchange, free trade, and wealth creation. But governments insist on getting in the way, and extorting our money from us with their menaces.

Longstanding readers will be familiar with our strong belief that, because government intervention in the economy always has consequences, many of which run counter to what it often claims to be supporting, government itself should be kept as small as possible, in order that it do as little inadvertent damage as possible. The argument is best advocated and summarised in this book and its title: Forty Centuries of Wage and Price Controls – how not to fight inflation. (The link allows you to download a PDF copy of the book, entirely free, from the Mises website.) Please note that we are not – yet – anarchists; we believe that government should be kept small, in order to minimise its interference in the productive lives of those in the private sector (who make government possible in the first place, through their taxes), not that it should not exist at all. But as every day goes by in this madhouse of a world, the anarchist perspective becomes more and more desirable.

Our tortuous collective pilgrimage of the last nine years in the vague direction of Brexit, for example, has done a lot of things. Perhaps most weirdly, it has reinforced the Marxist credentials of both ‘The Economist’ and the ‘Financial Times’. You thought that these journals were pro-business, pro-free market, and anti-Big State ? Yes, we used to think that, too.

Suffice to say, regardless of which way you voted in the EU referendum, if you did, we doubt whether you can be satisfied at the outcome to date. Many Remainers will be placated by nothing other than re-entry into the European Union. Leavers and Remainers will likely be equally aghast at the travesty of supposed negotiation that has occurred to date. To trace the problem back to its source, we cite a longstanding influence on our own fundamental macro-economic and investment thinking, the late Dr Albert Bartlett, physics professor at the University of Colorado at Boulder, and the presenter of what has been quite fairly described as one of the most important videos that you’ll ever see (which you can watch here). Bartlett suggested that one of mankind’s greatest failures was our inability to understand the power of the exponential function, also known as the miracle of compounding. Bartlett went on to advocate the contentious-sounding thesis that for any entity beyond maturity, further growth equates either to obesity, or cancer. Ladies and gentlemen, we present: the European Union. (Lest we be accused of geographic or political bias, we also present: the US national debt.)

But if, like us, you believe that government should be as small as humanly possible in order for it to be less rather than more harmful (the Swiss model being a particularly good one), you cannot then logically endorse the European project.

For many Leave voters, the matter of sovereignty carried more weight than any other single issue. Economic matters were of secondary, though still crucial, importance. Our own hostility to the European project derived from a pragmatic acknowledgment of the human condition. Humans are tribal creatures. Technocrats in Brussels may believe that it’s possible to subsume national identities within a larger pan-national bureaucracy, but we doubt whether the majority of the people of France, Italy, Greece and the other members of the remaining EU 27 really desire that outcome.

To reiterate a longstanding observation, the members of a centralised euro currency zone are trapped within a latter-day gold standard. Because its member countries have no control over their own monetary policy, they must accept a one-size-fits-all model. But what is appropriate today for an economy like Germany’s is unlikely to be appropriate for an economy like that of Greece. (Which should never have been allowed to join in the first place – but then institutionalised corruption is another of the euro zone’s fatal flaws. Are the EU’s accounts and payments “free from material error” ? On this basis they haven’t been signed off by the EU’s own Court of Auditors for over 20 years.)

The euro zone is simply too big to function properly. Given the widely various cultures of the euro zone, it was always going to be a big ask for such a diverse patchwork of countries to try and move lock-step together.

As JP Morgan’s Michael Cembalest points out, there is disturbingly little commonality amongst those disparate cultures. The graphic below shows DNA mappings of European citizens (courtesy of ‘Current Biology Magazine’, August 2008). While genetic variations are relatively small, those variations are tied very closely to geography. As Cembalest observes, by grouping similar DNA results together, we get something that looks very much like a map of Europe – a map that reflects “hundreds of years of migration, weddings, funerals, births, language, values passed to children, circumstances that call for charity, sacrifice, revenge and everything else that defines ‘culture’.”

As Cembalest puts it,

“The map shows clear patterns of ancestry tied to geography, which is perhaps why the EMU was designed to retain the region’s fiscal, economic and cultural identities. Perhaps we should not be surprised that Northern Europe is struggling with whether it will mortgage its future to save the South.”

And perhaps the ultimate will to save Europe simply does not exist.

“In terms of shared experiences and values measured by anthropologists, and the contours of history implied by genetic research, they may not have enough in common. It took almost 150 years for the US to reach the same point in its history, when it began to cede more control to a Federal, centralised government.”

Whenever sceptics expressed concern at the EU’s uncertain direction of travel and its acceleration regardless, it was met with a standard response: the answer is more Europe. Well, not any more. Not for the UK, at least.

The tragedy for the benighted people of the United Kingdom is that, just when we were at the point of shaking off the shackles of our economic ties to Europe, enough of us voted for a Labour government under Keir Starmer that seems determined to drag us back in, albeit on the worst commercial terms imaginable, and which never saw a tax hike that it didn’t like. So the opportunity to remake the UK as Singapore-on-Thames now looks to have been entirely squandered.

The dismal collapse of Britain’s economic prospects reflects a sublime inability (or steadfast refusal) to recognize the superiority of Adam Smith’s world of free trade, entrepreneurialism and invisible hands. All of which have been replaced by the Big State’s all too visible hand as it reaches into our collective pocket in search of capital to perpetuate its economically unviable pipe dreams. Labour hates success, and it hates wealth unless it represents the increasingly narrow interests of its voter base.

All of which provoked ‘The Telegraph’ in its editorial of 8th July 2025 to issue the following verdict:

“It is difficult to think of a better summary of Britain’s difficulties than that offered by Richard Hughes, chair of the Office for Budget Responsibility: “the UK cannot afford the array of promises that it has made to the public”.

“This observation was backed by dismal forecasts showing debt on course to reach 270 per cent of GDP by 2070, and the note that challenging global and domestic circumstances risk further shocks to the public finances. Yet at Westminster there is little sign that MPs have realised the precarious position Britain finds itself in. Indeed, Labour’s 2024 intake of MPs seem to believe that the Government’s finances are limitless in their depth.

“The rebellion that recently rocked the Government was over a £5 billion cut in a health and disability benefits bill set to reach £70 billion a year by 2030 – a fraction of the forecast spend. The result was another U-turn in attempts to arrest rising spending, going alongside the failed attempt to reform old-age benefits.

“This, in turn, suggests that Britain’s finances will continue towards what Mr Hughes calls an “unsustainable position” until we are jolted from our complacency by the vigilance of the bond markets, or an even less desirable intervention. It would clearly be preferable to rein in the growth of spending now, voluntarily.

“The older meaning of the word “crisis” as a turning point in a malady is apposite here. The British disease – welfarism, an elite class unwilling to reckon with the need for change, a state that strangles entrepreneurial activity and investment – is reaching its peak. Whether the patient will recover before extraordinary measures are necessitated is unclear.”

According to the popular maxim, hard times create strong men; strong men create good times; good times create weak men; and weak men create hard times. We think a 2025 revision is overdue: hard times create entrepreneurs; entrepreneurs create good times; good times create weak men; and weak men form Labour governments. We need to relearn the lessons of Adam Smith and of Nassarius – in a hurry.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price