“Gold was present in the dust that formed the solar system. It sits in the earth’s crust today, just as it did when our planet was formed some 4.6 billion years ago. That little bit of gold you may be wearing on your finger or around your neck is actually older than the earth itself. In fact, it is older than the solar system. To touch gold is as close as you will ever come to touching eternity.”

- Dominic Frisby, ‘The Secret History of Gold’.

Get your Free

financial review

Take that, Bitcoin. There is a reason why some of us are wary of ascribing too much value to Satoshi Nakamoto’s ‘digital gold’, given that it is only just celebrating its 17th birthday. Bitcoin isn’t even old enough to vote.

Despite having invested in gold bullion and gold miners for the last 25 years, and having the scars to prove it, we were delighted to come across some anecdotes about the yellow metal in Dominic Frisby’s book that were new to us. Those interested in the history of money, trade, banking, coinage and colonial slaughter will not be disappointed. As a primer on economics, inflation and currency and money creation, a good history of gold fills in an awful lot of blanks.

The chapters relating to the various 19th Century gold rushes are particularly enjoyable. Perhaps our favourite piece of data comes from the California gold rush that began in 1848:

“So many domestic servants abandoned their jobs that there was a shortage and, for a period, a domestic servant could earn as much as congressmen. In California, there was a huge shortage of women, so ‘female services’, from washing, ironing and cooking to prostitution, commanded fortunes. It would cost fifteen ounces of gold to spend the night with a lady ($40,000 in today’s money).”

(One might quibble with whether this justified the term ‘lady’.)

And the chapters relating to the efforts given to spirit ill-gotten gold away during wartime are also compelling – there is enough material here for Hollywood to fashion a dozen blockbusters.

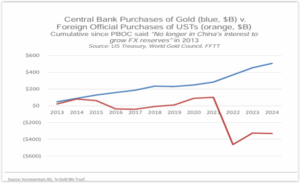

As early reviewers have been quick to point out, the publication of this book is especially timely. Gold (and latterly silver, along with other commodities) has been on a tear this year, reflecting the growing desire on the part of central banks to park their reserves in something other than US Treasury bonds and US dollars (and other fiat currencies). This trend accelerated after the West decided it would be a good idea to freeze the foreign reserves of a sovereign nuclear power – that owned US Treasury assets – following its invasion of Ukraine. Central banks, especially those unaligned with the US, have increasingly favoured the stateless asset that is gold. As the chart below indicates, courtesy of Incrementum, while central banks have bought gold, they have actively disinvested from US Treasury bonds.

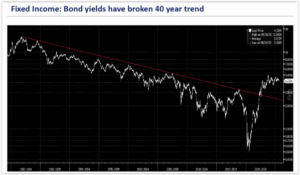

And there are technical factors behind the declining popularity of US Treasuries: bonds are now in a secular bear market, and have been for the last several years, as the chart below, via Bloomberg, shows.

As the strategist and financial historian Russell Napier commented earlier this year,

“You shouldn’t own any fixed interest securities. None. Inflating away debt means destroying the purchasing power of fixed interest securities. There may be rallies, but fixed income is in a long bear market. Bond bull and bear markets move in about 40 year periods, and now we are into year 3 of the current bear market. You can lose a fortune in real terms over the long term. Therefore: no bonds. Period.”

While central banks have been making most of the running when it comes to gold purchases, private investors have so far been slow to respond, perhaps hypnotized by the recent returns from ‘investments’ in AI; Ruchir Sharma, writing in the FT, points out that AI companies have accounted for 80% of the gains made by US stocks during 2025. UBS, in a recent survey of family offices, indicates that these investors currently have a typical allocation to gold and precious metals of approximately 1%, and to commodities of less than 1%, which suggests that this gold run has only just started.

At a time when sovereign balance sheets across the world are looking dangerously stretched and unpayable debt loads are starting to infect currency markets, gold stands out as the form of capital that cannot be depreciated at will by craven politicians and monetary technocrats. It has no credit risk, currency risk or counterparty risk, and has maintained its purchasing power over thousands of years. As ‘The Secret History..’ makes abundantly clear, gold is a special type of asset, and it always will be.

‘The Secret History of Gold: Myth, Money, Politics & Power’ by Dominic Frisby is published by Penguin Life.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and real assets, and also in systematic trend-following funds.

“Gold was present in the dust that formed the solar system. It sits in the earth’s crust today, just as it did when our planet was formed some 4.6 billion years ago. That little bit of gold you may be wearing on your finger or around your neck is actually older than the earth itself. In fact, it is older than the solar system. To touch gold is as close as you will ever come to touching eternity.”

Get your Free

financial review

Take that, Bitcoin. There is a reason why some of us are wary of ascribing too much value to Satoshi Nakamoto’s ‘digital gold’, given that it is only just celebrating its 17th birthday. Bitcoin isn’t even old enough to vote.

Despite having invested in gold bullion and gold miners for the last 25 years, and having the scars to prove it, we were delighted to come across some anecdotes about the yellow metal in Dominic Frisby’s book that were new to us. Those interested in the history of money, trade, banking, coinage and colonial slaughter will not be disappointed. As a primer on economics, inflation and currency and money creation, a good history of gold fills in an awful lot of blanks.

The chapters relating to the various 19th Century gold rushes are particularly enjoyable. Perhaps our favourite piece of data comes from the California gold rush that began in 1848:

“So many domestic servants abandoned their jobs that there was a shortage and, for a period, a domestic servant could earn as much as congressmen. In California, there was a huge shortage of women, so ‘female services’, from washing, ironing and cooking to prostitution, commanded fortunes. It would cost fifteen ounces of gold to spend the night with a lady ($40,000 in today’s money).”

(One might quibble with whether this justified the term ‘lady’.)

And the chapters relating to the efforts given to spirit ill-gotten gold away during wartime are also compelling – there is enough material here for Hollywood to fashion a dozen blockbusters.

As early reviewers have been quick to point out, the publication of this book is especially timely. Gold (and latterly silver, along with other commodities) has been on a tear this year, reflecting the growing desire on the part of central banks to park their reserves in something other than US Treasury bonds and US dollars (and other fiat currencies). This trend accelerated after the West decided it would be a good idea to freeze the foreign reserves of a sovereign nuclear power – that owned US Treasury assets – following its invasion of Ukraine. Central banks, especially those unaligned with the US, have increasingly favoured the stateless asset that is gold. As the chart below indicates, courtesy of Incrementum, while central banks have bought gold, they have actively disinvested from US Treasury bonds.

And there are technical factors behind the declining popularity of US Treasuries: bonds are now in a secular bear market, and have been for the last several years, as the chart below, via Bloomberg, shows.

As the strategist and financial historian Russell Napier commented earlier this year,

“You shouldn’t own any fixed interest securities. None. Inflating away debt means destroying the purchasing power of fixed interest securities. There may be rallies, but fixed income is in a long bear market. Bond bull and bear markets move in about 40 year periods, and now we are into year 3 of the current bear market. You can lose a fortune in real terms over the long term. Therefore: no bonds. Period.”

While central banks have been making most of the running when it comes to gold purchases, private investors have so far been slow to respond, perhaps hypnotized by the recent returns from ‘investments’ in AI; Ruchir Sharma, writing in the FT, points out that AI companies have accounted for 80% of the gains made by US stocks during 2025. UBS, in a recent survey of family offices, indicates that these investors currently have a typical allocation to gold and precious metals of approximately 1%, and to commodities of less than 1%, which suggests that this gold run has only just started.

At a time when sovereign balance sheets across the world are looking dangerously stretched and unpayable debt loads are starting to infect currency markets, gold stands out as the form of capital that cannot be depreciated at will by craven politicians and monetary technocrats. It has no credit risk, currency risk or counterparty risk, and has maintained its purchasing power over thousands of years. As ‘The Secret History..’ makes abundantly clear, gold is a special type of asset, and it always will be.

‘The Secret History of Gold: Myth, Money, Politics & Power’ by Dominic Frisby is published by Penguin Life.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and real assets, and also in systematic trend-following funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price